How to Apply CAGD Loan and Salary Advance in 2026

Running low on cash before payday? You’re not alone, many Ghanaian government workers need extra cash before payday. The GOGPayslip portal is the online system that provides the facility of Loan and advance salary to the civil servants of Ghana. The Portal allows public sector employees to see and download their monthly salary slips. These electronic payslips are important proof of income, and banks ask for a payslip when you apply for a loan or a salary advance. In this article, we explain in simple steps how a government worker in Ghana can use GOGPayslip and other resources to get a salary advance or bank loan.

What is GOGPayslip (EPayslip)?

GOGPayslip is a secure online platform created by Ghana’s Controller and Accountant General’s Department (CAGD). It lets Government of Ghana (GoG) employees access their payslips online. Through GOGPayslip you can check your earnings, taxes, deductions and salary slip anytime. This Portal saves time and makes the payroll process transparent.

What Is CAGD Loan or Advance Salary?

An advance salary loan (salary advance) is a short-term loan where you borrow a part of your salary before your actual payday. You might take a 50–75% advance of next month’s pay and then return the Loan from your actual salary. Interest on salary advances is lower than on other loans, and repayment is also easy, you can pay within 3 months. These loans help cover emergencies and unexpected bills between paydays.

In Ghana, many banks and lenders offer a salary advance to workers. For example, Fidelity Bank Ghana has a Salary Advance facility that gives up to 60% of your net monthly salary, which is repayable in the next 3 months. OmniBSIC Bank offers up to 75% of one month’s salary as an advance, which will be repaid in 90 days.

Who Can Get Salary Advance or CAGD Loan?

Most salary advance loans are for employed people with regular income. As a Ghanaian civil servant, you typically qualify if you are on the Controller and Accountant General’s Department (CAGD) payroll. Banks often ask specifically for CAGD Payslips. You can get a salary loan if you are:

When you apply for a loan or salary advance, Banks will check your payslips and the CAGD portal for an “Affordability”. They will see how much your salary is and what your loan limit is. In simple terms, your total Loan depends on your net pay and existing deductions. If you meet the bank’s criteria, you can proceed to apply.

Step-by-Step: How to Apply for a Loan or Salary Advance

Follow these steps to use your GOGPayslip and get a loan or salary advance:

Step 1: Check Your Eligibility

To start the procedure, make sure that you are eligible for the loan or salary advance. Ghana public sector employees under 60 years and on the CAGD payroll can avail this opportunity.

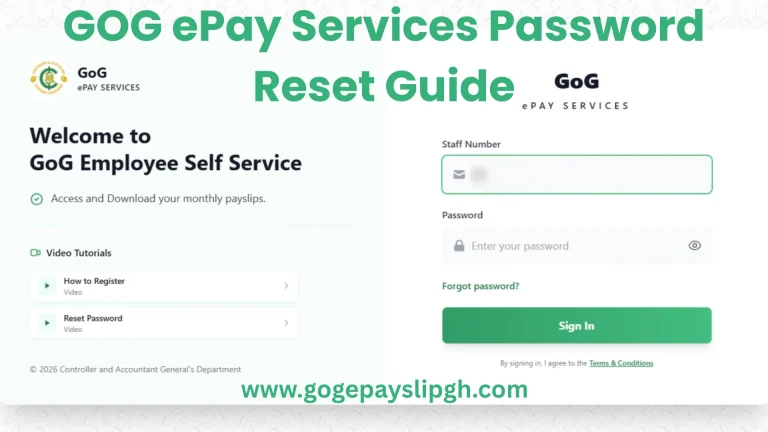

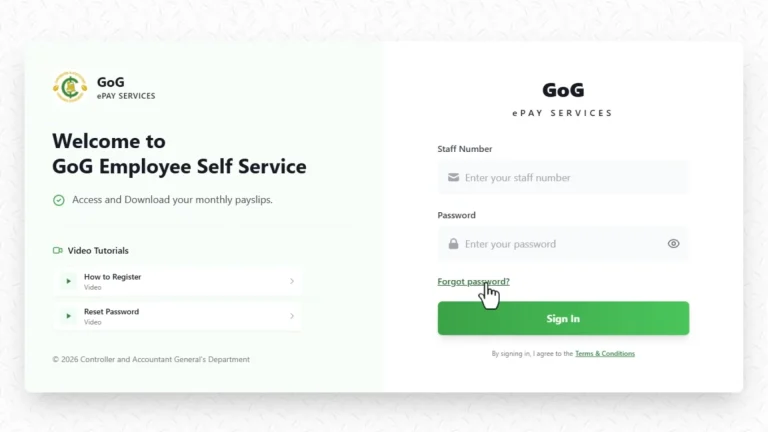

Step 2: Register and Login to GOGPayslip

If you have not used GOGPayslip before, register yourself on the Payslip Portal. Ask your HR department or validator for a first time registration code. Then visit www.gogpayslip.com and complete the registration form. After confirming your Employee Number and setting a password, you will activate your account via an OTP code. If you already registered, log in with your employee number and password.

Step 3: Download Your Payslips

After logging in to your account, click on “My Payslip”. Select the current month and click “Download” to save the PDF of your salary slip to your phone or computer.

Step 4: Find a Loan Provider

Select banks or lenders that offer salary loans or CAGD loans for government workers. Check their terms and conditions to understand that the Loan fulfills your requirements.

Step 5: Prepare Required Documents

Ready your documents to apply for the loan. Most banks will ask for:

Step 6: Submit Your Application

Go to the bank branch or online platform of the bank, and submit your loan application with the required documents. The bank will verify your payslips and calculate your Affordability or maximum loan amount based on your salary.

Step 7: Get Approved & Receive Funds

When your loan is approved, the bank will sign a loan agreement, and you will get your funds. Your loan repayments will be deducted automatically from your future payslips (often via the CAGD payroll) until the Loan is fully paid back.

Top Banks and Loan Schemes For Employees

Here are some major Ghana banks and their salary loan offers for government workers:

Conclusion

In Ghana, the Payslip portal has made it very easy for public servants to apply for loans and salary advances. By logging into GOGPayslip, you can instantly get the payslip needed as proof of income and apply for a loan or a salary advance. To get a salary loan, make sure you’re eligible, download your payslips, choose a loan provider, and submit the necessary documents. With the right documentation and a clear salary record, you can get the Loan or advance you need. Keep your GOGPayslip account active and know your Affordability to use these loan options with confidence.

One Comment