Check EPayslip Loan Affordability in GoGPayslip Portal

Managing money wisely isn’t always easy and you always need to know your Affordability especially when you are considering loans or financial commitments. For Government employees in Ghana, the CAGD offers Loan and advance salaries through the GoGPayslip platform. The Payslip Portal helps GOG workers to manage their financial situations through the “My Affordability” feature, This Feature helps employees to find out their capacity to avail loans based on their current salary and deductions. The lenders ( Banks and Organizations) check the affordability of employees to decide the loan approval. This also helps employees in money management and to control expenses.

Understand “My Affordability”

The “My Affordability” feature on the GoGPayslip platform allows government employees to know their eligibility for loans by checking their existing financial obligations relative to their income. This feature is important for both employees and lenders to ensure that getting a loan is manageable and does not create financial problems . By having a clear knowledge of one’s financial position, it’s easy to decide the approval of a loan.

How to Check “My Affordability” on GoGPayslip

To check your affordability status on the Portal follow these simple steps:

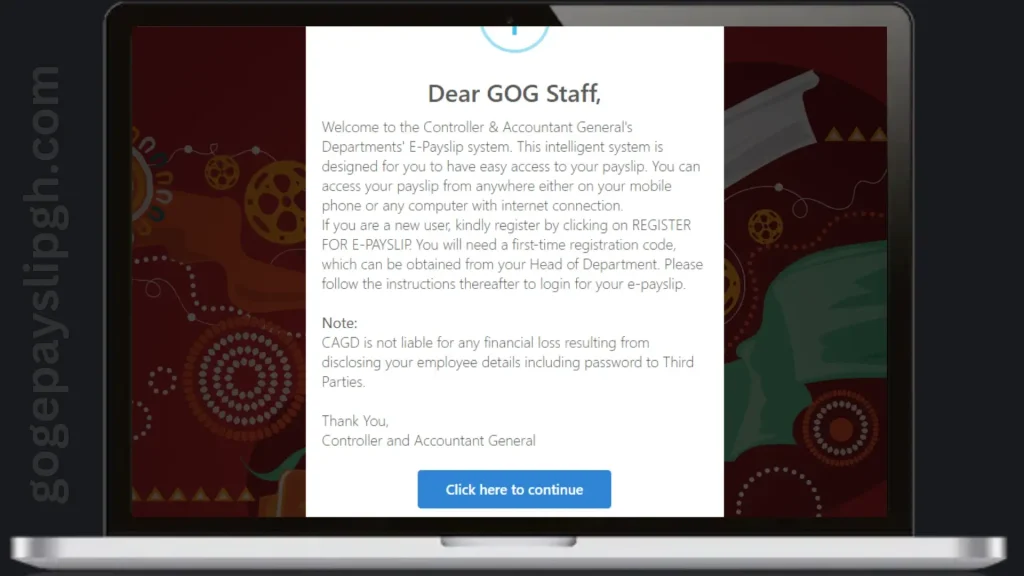

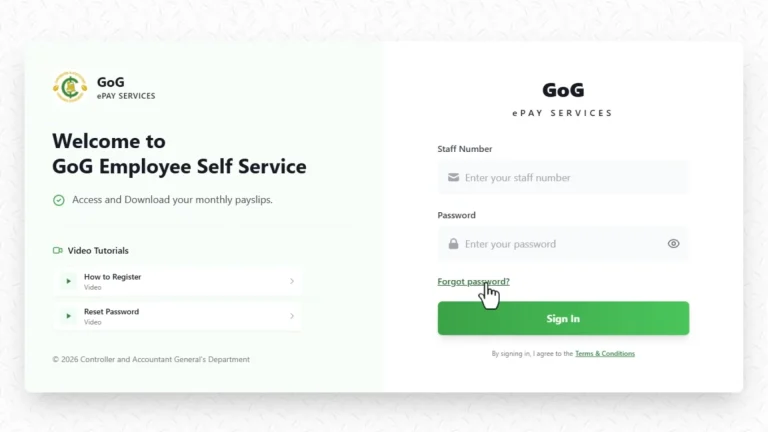

Step 1: Visit the Official GoGPayslip Website

Visit the official website of Epayslip by clicking on this link www.gogpayslip.com.

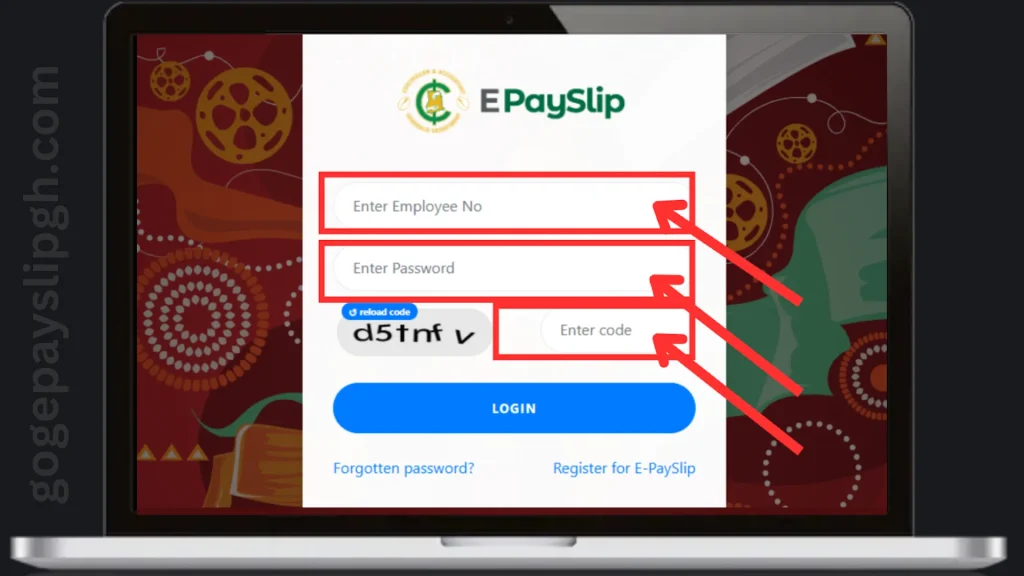

Step 2: Log In to Your Account

Login to your epayslip Portal account by entering the following details.

Enter Your Employee Number: This unique Employee number is given to GOG workers by the Government of Ghana.

Enter Your Password: Enter the unique password you created during your registration.

Enter the Security (Captcha) Code: A captcha code will be shown on the login page. Type this code in the box to verify that you are a human, not a robot.

Click “Login” Button: After entering all the information, click the “Login” button to access your Portal.

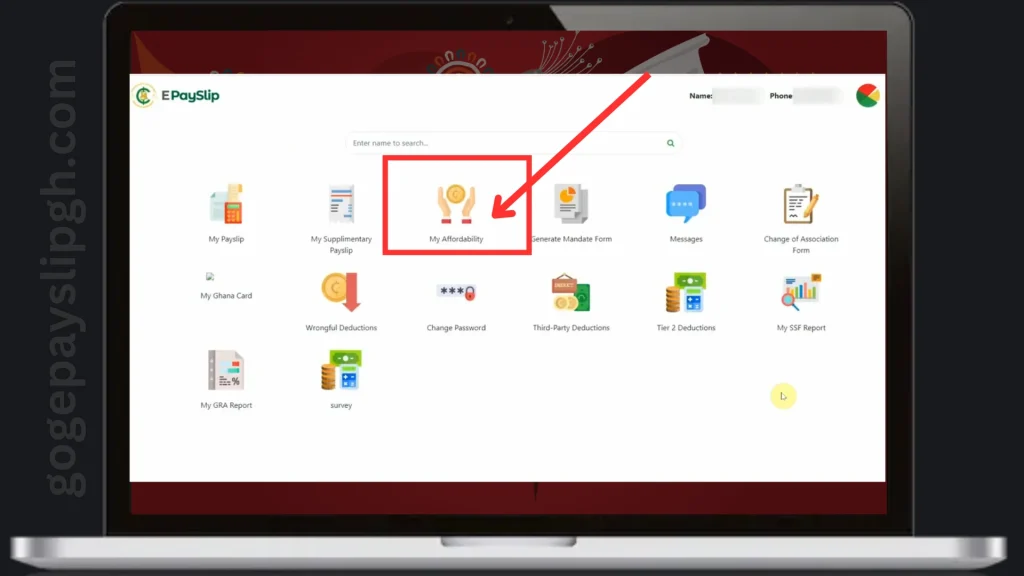

Step 3: Navigate to the “My Affordability” Section

As you logged in now, you’ll be on the homepage of the salary Portal. Find the “My Affordability” option from the other salary related options and click on it.

Step 4: View “Affordability” Details

As you click and open the “My Affordability” tab it will display your current affordability details.

Check for the following details:

Step 5: Download “Affordability” Report

After checking and verifying the details of your affordability, now you can download your affordability report to print or to save for later use.

How is “My Affordability” Calculated?

The Affordability of Government employees is calculated to check how easily Employees can repay the loan. The Government of Ghana provides affordability report in Epayslip portal to:

Affordability is calculated on the basis of Debt to Income ratio of Employees. For this purpose the Government of Ghana checks the net income of employees and assumes that an employee can use 30% of his monthly income to repay the installments of loan. So in this way the amount of loan is calculated.

Tips for Using “My Affordability”

Regular Monitoring: It is good to check your affordability regularly, specially before applying for new loans. This will help you to stay informed about your financial situation and avoid taking extra loans.

Update Personal Information: Make sure that your personal and financial information (Bank details) on the GoGPayslip portal is updated regularly.

Consult Financial Advisors: If you want to apply for a loan, you should consult with financial experts and discuss your affordability with them. In this way you can decide your installments and new loans.

Benefits of “My Affordability”

This feature of the salary slip portal facilitates the employees in many ways. Some of them are mentioned below:

Informed Decision-Making: when you understand your affordability and financial condition you can make better financial decisions. You can control your expenses and increase savings.

Transparency: The feature promotes transparency between employees and lenders (Banks and Loan companies).

Financial Planning: After knowing your affordability status you can do an effective financial planning. It helps you to manage your income, expenses, and savings easily and efficiently.

Learn about “My Affordability”

If you want more information on managing your finances and understanding your loan affordability. You can use these resources

Financial Literacy Programs: The Government of Ghana and many other organizations (banks and loan companies) offer financial literacy programs that provide education on budgeting, saving, and investing. You can participate in these programs to increase your knowledge.

Credit Counseling Services: If you get stuck and facing money related challenges. Then you can get help from credit counseling services to get a plan to manage your debts effectively.

Online Financial Tools: Now in modern days different online calculators and tools (Budgeting apps and Loan instalment calculators) can help you to calculate your affordability and make plans for your finances.

Conclusion

The “My Affordability” feature on the GoG EPayslip portal is very valuable for Ghanaian Government employees to check their financial situation and apply for new loans. Regular use of this feature will help you to control your extra expenses and avoid unnecessary debt. By following the above mentioned steps, you can easily check your affordability status, make professional financial decisions and improve your stability.

3 Comments