Salary and Wages System of Ghana – Minimum Wages 2026

The salary of Ghana’s government employees is calculated through the Single Spine Salary Structure (SSSS), a pay scale introduced in 2010 and managed by the Fair Wages and Salaries Commission (FWSC). The SSSS organizes the salaries of different jobs by standard grades so every employee of the same grade from any department gets the same salary. With this system, the Government of Ghana makes sure that all employees of the same grade and the same years of service are paid equally.

Additionally, many public servants receive market premiums, a type of extra allowance for specialized professions like teachers, doctors, and engineers. In 2026, the Ghanaian Government implemented a 10%across the board increase in the SSSS base pay for all public sector workers. The National Daily Minimum Wage also increased by 10% in March 2025, reaching GHS 19.97.

Salary Structure of Ghana

Ghana uses one main pay system for government workers called the Single Spine Salary Structure (SSSS). It works like a ladder. Every worker has a grade and a step on this ladder. People with similar jobs and skills get the same pay, no matter which department they work in. In general:

Private sector wages in Ghana are much different from the Government sector. Companies set their own salary rates, but public workers follow the Single Spine for fairness. The Government and Public service unions negotiate major pay changes from time to time.

How Ghana’s Salary Structure Works

Under the Single Spine system, the basic salary of every public worker is set by the law according to their grade and years of service. On top of that, you get allowances. The payslip in Ghana has these common allowances:

For example, if your basic salary is GHS 50,000, a 10% housing allowance is GHS 5,000 on top of your basic pay. All allowances added together (plus any overtime or bonuses) from your gross salary. Each allowance is Listed separately on the GoGPayslip. According to the rules, when you move up the Single Spine (get promoted or more experience), your basic pay and allowances will also increase.

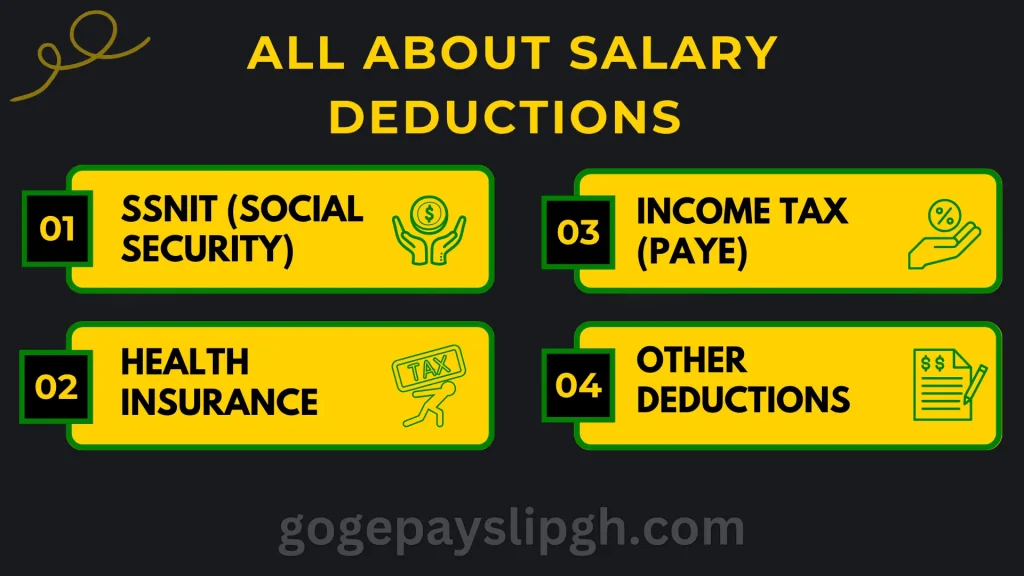

All About Salary Deductions

Your gross pay is not the amount you get in your pocket. Several deductions (SSNIT, Tax, and NHIS) are taken first, and then the salary is transferred to your bank account. The main deductions on a Ghanaian payslip Poral are:

SSNIT (Social Security) Contribution

Ghana’s pension fund is managed by the Social Security and National Insurance Trust (SSNIT). Each month, a portion of your salary is deducted for SSNIT (5.5% for employees) to fund your retirement pension. In your pension, your employer also contributes. On the payslip, this appears as a “Provident Fund (PF)” or “SSF” deduction. You can verify these SSNIT deductions on the payslip portal by checking the “My S.S.F Report” tab.

Income Tax (PAYE)

Ghana uses a progressive tax system of up to about 30%. A fixed portion of your gross pay is taken by the Ghana Revenue Authority (GRA) before you get paid. The GoGPayslip portal also shows a “My GRA Report” section so you can check exactly how much tax has been taken from your salary.

Health Insurance

Ghana’s National Health Insurance Scheme (NHIS) is funded by a small tax on salaries (around 2.5%). If you are NHIS-registered, a 2.5% NHIS deduction is taken from your pay. This supports your health insurance.

Other Deductions

If you have loan repayments like a vehicle loan, mutual fund loans or union dues. These loan repayments are also paid from your salary. The EPayslip portal lets you see these “Third-Party Deductions” or “Loan Deductions”.

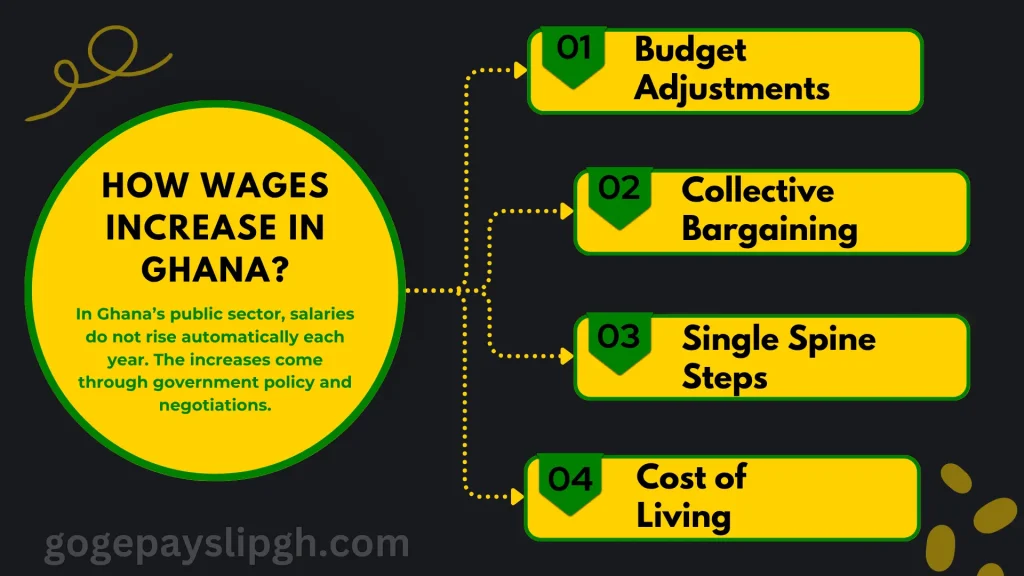

How Wages Increase in Ghana

In Ghana’s public sector, salaries do not rise automatically each year. The increases come through government policy and negotiations.

Budget Adjustments

Sometimes the President or Ministry of Finance announces a general raise (e.g. 5% or 7.5%) for public workers to compensate for inflation or to reflect economic growth.

Collective Bargaining

Public-sector unions (like teachers, nurses, and civil servants) may negotiate higher pay or allowances with the Government. Due to this bargaining and agreements with the Government can lead to a salary increase for certain groups.

Single Spine Steps

Within the Single Spine System, your salary does increase with years of service and promotions. Even without a general raise, you move up the spine with years of experience.

Cost of Living

In times of high inflation (rapid price increases), there is public pressure on the Government to increase wages to help workers keep up.

There is no fixed schedule for a raise in wages. Some years see a rise when budget conditions allow, and other years may have no salary increment. When a new raise is approved, it affects the payslips, and the EPayslip portal will show any higher basic pay or allowances immediately.

How Employees Receive Their Monthly Salary

Government workers of Ghana are paid once a month via direct deposit into their bank accounts. The Controller and Accountant General’s Department (CAGD) processes the payroll for all public servants. Once payroll is finalized, the GoGPayslip portal sends a notification to workers that their new payslips are available online. Typically, salaries are paid around mid-month or on a scheduled date (many ministries pay by the 15th or end of each month). The EPayslip portal is updated only after payroll is done and salaries are transferred to bank accounts, so checking the portal means your salary has been paid. More simply, you get a bank transfer and can check the details on your Payslip account.

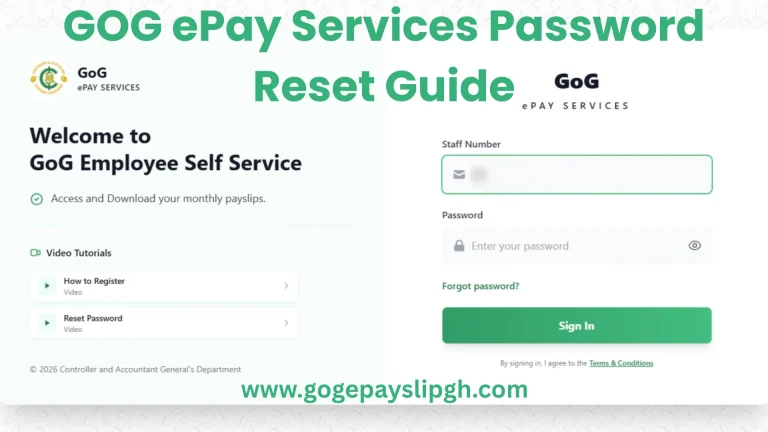

Role of GoGPayslip EPayslip Portal

The GoGPayslip portal is Ghana’s official EPayslip system for Government workers. It is managed by the Controller and Accountant General’s Department (CAGD). The portal’s main purpose is to make payslips easy to access, secure, and transparent. Instead of going to HR, you can view and download your salary slip anytime online. Key benefits of EPayslip include:

Conclusion

Understanding your payslip and salary structure in Ghana is key to managing your money. In summary: A payslip shows your basic salary + allowances = gross pay, then subtracts deductions (SSNIT, Tax, NHIS) to give your net pay. Ghana’s public servants use a unified Single Spine pay scale, and allowances are usually fixed percentages of basic pay. The GoGPayslip EPayslip portal makes it easy to access all this information online. You can log in to see your detailed payslip each month, check your SSNIT (retirement Pension) and tax contributions, and plan your finances. By checking your EPayslip regularly, you stay informed and can ensure you’re paid correctly.

One Comment